Macro Digest: Georgia on my mind

(Photo : The famous « Freedom Square », central place of the Georgian capital Tbilisi. The country could perform 5% growth of GDP in 2015.)

—

- Georgia quickly becoming a hub for transport and finance

- Country is an extremely attractive tourist destination

- Downside includes weak currency and massive CA deficit

- Georgia is profoundly misunderstood – that’s another hurdle

- Current account deficit must be transformed into productivity

I write this as I return from a three day trip to Tblisi, Georgia where I helped launch G&T Trader, the online trading platform of Galt & Taggart, the investment arm of our new partner, Bank of Georgia.

I have to admit being in Georgia is the biggest positive surprise this year! By far! Here is a tiny country where less than seven years ago Russian tanks were circling the motorways outside the capital of a place that believes in liberty and incentives.

For the past several years Georgia has been emerging as a transportation hub, a local financial hub and in the words of my hosts: using the fact that Georgia in the old CIS structure was the Italy of Eastern Europe. They have the food, wine, beaches and skiing.

On top of this Georgia is also the most easterly country in Europe – the gate through which you enter into Asia – which of course makes it part of the Silk Road and hence a probable beneficiary of FDI from not only China but also western companies wanting to make a foothold in the CCA region.

The downside?

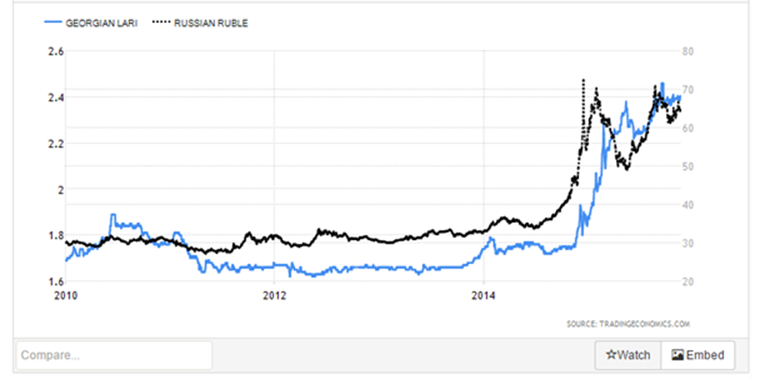

Three things come to mind: A massive 10% current account deficit, an extremely weak currency, the Lari, (GEL is the ISO code) and a misunderstood story.

The current account deficit needs to be converted into productivity and it’s starting to happen, but Georgia remains extremely dependent on foreign lending and the 35% of the population living outside Georgia. Remittances amount to 9% of GDP and remain an important source of funding.

The currency needs to come under “control” – it has followed the TRY and RUB lower, but there seems to be a thinking that the weak GEL pays for some of the lost revenue from the region seen through lower oil prices.

I disagree, there needs to be a “strong Lari’ policy commitment or at least a stable one, as the country is short of the funding it needs to preserve the value of investments. Furthermore, coming from a very low GDP per capita ($10,000 in PPP terms) it certainly needs to improve not only productivity but also to create pressure to improve competitiveness through an upgrade of better quality through investments and catch-up on technology.

Probably the biggest barrier though is the misunderstood story:

Georgia is not, as one could think, a mirror of Russia, it is dependent on the business cycle of Russia but through oil (as oil rich Azerbaijan) remains a huge trade partner – actually it strikes me that Georgia tries to do everything exactly the opposite of what Russia does.

Worryingly, a barrier to progress is embedded in the constitution: There can be no new taxes without a vote in parliament, public spending can be a maximum of 30% of GDP, and failure to comply will mean the fall of the government.

The ambition is to create a Singapore for the region, based on servicing the needs of the surrounding countries. Food, wine, holidays, beaches, skiing, casinos’s and banking – there is big inflow of capital from less open societies – in the region Georgia is perceived to be a safe place – it’s corruption ranking is just behind …. Denmark! Furthermore, the government operates one of the most open architectures I have seen anywhere including in Scandinavia.

The misunderstood story is easy to explain – the skirmish in 2008 with Russia remains on most investors’ radars, but considering the response, the mandate for change created through this crisis, Georgia becomes a miniature experiment of what I have tried to preach again and again when travelling the world.

Any crisis is an opportunity to change and cement new forward looking best practices and actions and the Georgians have already done much:

They’ve enabled the incentive structure through reducing the public sector to a ratio below 50%; reduced the complexity of tax laws and made the public sector a proper service organisation helping the economy as opposed to fighting it.

Georgia has achieved this in a very short space of time – the catch up effect has been the driver so far, now Georgia needs to convert its investments into productivity and growth, stabilise the Lari and put Georgia on the map.

I, for one, will keep a firm eye on not only my hosts Bank of Georgia’s stock, but also on the one mini experiment inside Europe, where they have accepted the challenge of change. A change away from their historic planned economic setup towards a model of an open society.

Georgia could very well be the next Singapore/Italy and Switzerland in one – and this is perhaps also the explanation why a statue of Ronald Regan is given pride of place in Tblisi’s Freedom Park.

When I sat down with Ronald at the end of the trip he asked me to give a thumbs up to Georgia – he liked what he saw from his bench overlooking Tblisi and so did I.

PS: I see the Lari – 5-10% stronger in 2016 on lower US$/stronger rouble.

PPS: One word of warning – they will try to “kill you” with their local excellent wine and food!

Safe travels,

Steen

Laisser un commentaire

Participez-vous à la discussion?N'hésitez pas à contribuer!