Dear All,

Quick note to follow up on my RECESSION risk is bigger than 60% call…… from the other week (Yes, I am yet to finish report….)

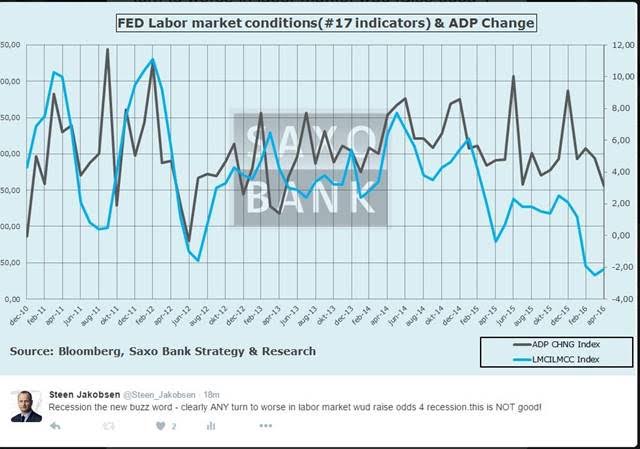

Recession risk is rising with big allocation implications – today’s ADP report is worst in three years!

Add to this that Fed broad based employment index (# 19 data points) is also making new lows and we have potential for dramatic change in MAIN MACRO concern: I.e: concern will be recession risk.

Classic economic theory reads that when labor market turns sour so does markets…..

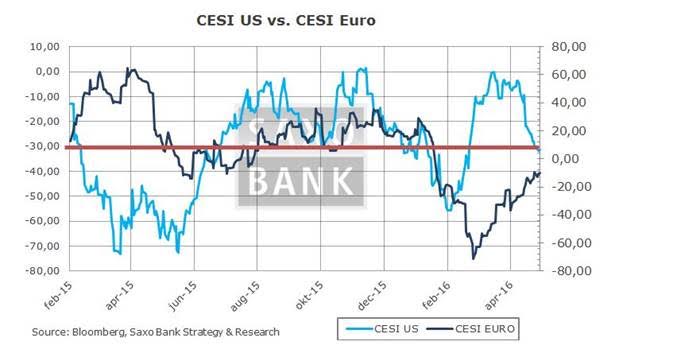

Economic data was ALREADY weak in the US.. .the labor being the “exception”…..(and unlike EUR which is doing better….)

Actual vs. Expected Economic data in the US and Europe

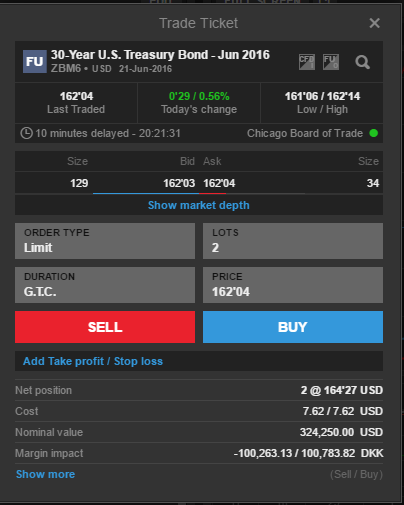

This means that we have and recommend an overweight in US fixed income – Our initial trade was done post the last FOMC meeting in this link: https://www.tradingfloor.com/posts/fomc-anoouncementfed-drops-reference-to-international-concern-but-maintains-strong-domestic-g-7531898

Action:

If Non-farm payroll on Friday confirm today’s ADP number then we could start a big move towards NEW LOWS in US yields…. this would also help EURUSD and Gold higher, but main move would be in fixed income where the market in my opinion is net SHORT

We remain:

Long JPY, GOLD vs. US Dollar..

Long energy & mining sector vs. short banks

Short US yield (Long 30Y US Treasury) and underweight S&P-500

Safe travels,

Laisser un commentaire

Participez-vous à la discussion?N'hésitez pas à contribuer!