Macro Digest : The coming US Dollar funding crisis?

My friends Neels and Mehul from Nedbank, South Africa does an amazing analyzing the global markets from a ‘different’ perspective – read better…

They have been kind enough to share this with me and now I want you to look at their latest FLAHS note as of 27 July where they warn about the signs of US Dollar funding crisis.

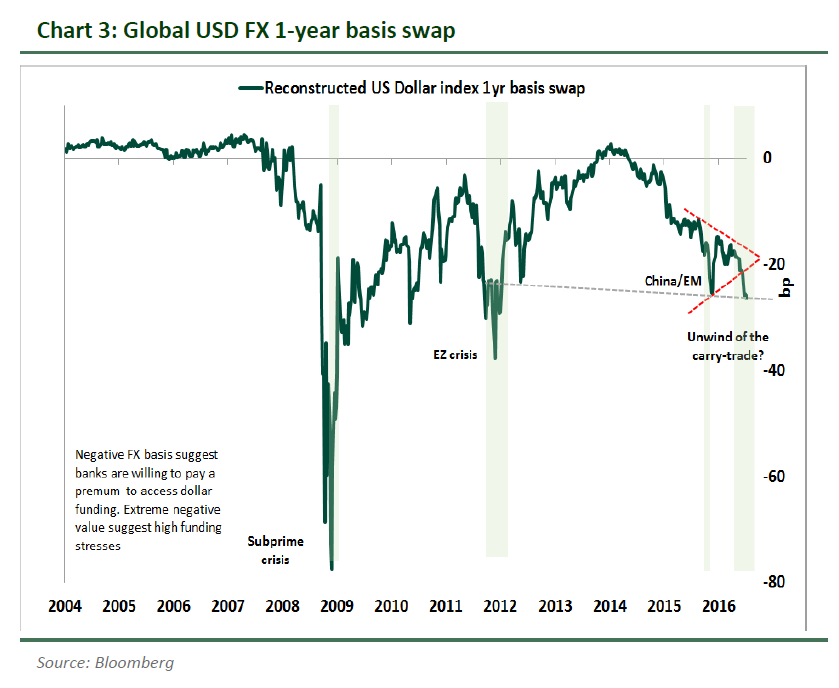

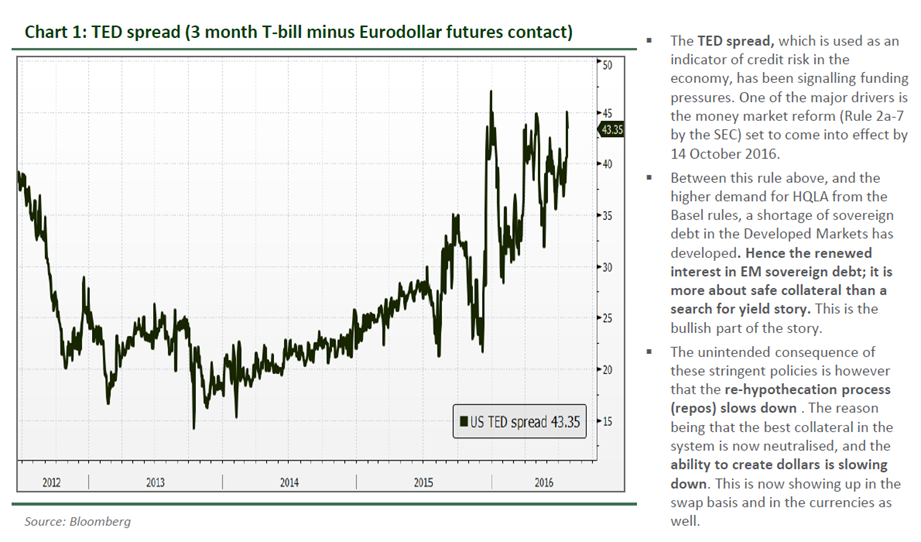

The two charts I like is the TED spread (as indicator of credit risk) and the good old basis swaps spreads (as indicator of how much banks wants to bid more for USD funding relative to other currencies)

As can be seen by this chart we are close to breaking down and putting additional pressure towards US Dollar strength.

You all know I am major US Dollar bear on long term, but I firmly believe balance of 2017 is about a global banking sector challenged by flat yield curve and NIRP as a tax on profit and capital. A world where while waiting for resolution of how to expand fiscal deficits, deal with early signs of banking crisis’ in Italy, Portugal, Spain, Australia, China and Germany, and accept the social contract implication which is more political noise and policy makers left with no additional tools

This means tighter financial conditions, rising TED spread, US funding bid over other currencies, weaker CNY and more noise – This means higher US Dollar which as you know….means less growth, less inflation, worsening EM and equity return.

We need to await the confirmation of Neels and Mehul’s work but it’s a direction which is unavoidable in my opinion as a world continues to follow Japan in shooting only two arrows out the three needed: The Fiscal and monetary policy ones – Japan may glue the two arrows together this week – but it’s not a third arrow (the reform arrow) – which is the only arrow which will works to increase productivity, CAPEX spending and growth …..welcome to more of the same with less and less results to show for it.

I look for DXY to strengthen and likewise EURUSD to test 1.05/1.06 and potentially even 1.000 before year is over.

Steen Jakobsen

Singapore, July 28th, 2016

Laisser un commentaire

Participez-vous à la discussion?N'hésitez pas à contribuer!