Steen’s Chronicle: ‘The past is unpredictable’

An old Russian proverb asserts that times past can be as uncertain as times to come, and given both Russia’s current circumstance and that of the global macro scene at large, it seems strangely apposite at the moment.

- Despite improving, Moscow desperately needs reforms

- ‘2018 is a make-or-break year for both Russia and the world’

- China determinedly moving toward global tech leadership

In Saint Petersburg, both the future and the past can seem unsettled, unclear, and unpredictable. Photo: Shutterstock

This past week took me back to one of my favourite spots for business: Russia.

Russia has always been kind to both Saxo Bank and I, but this time I sensed a small sadness, or a sense of disbelief, that felt deeper and more concerning to me than usual.

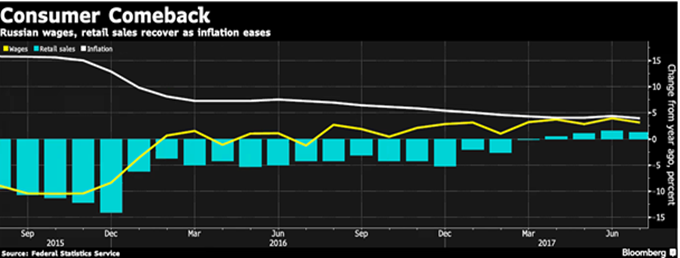

It was a little odd, as the Russian economic data are improving; the rouble and the Russian fixed income market have in fact been top performers over the course of the last 18 months.

The Russian recovery:

gor, my colleague, was kind enough to tell me that I simply want to understand too much, but I can’t help but see Russia as an enigma: a country with amazing potential and a history full of great artists, writers, and scientists, but also one built on a marsh of corruption.

Peter the Great was able to convert the marsh on which Saint Petersburg now stands into an empire via a combination of reforms and technology(shipping). I have been looking for a similar suite of reforms on each of my visits to Russia over the past 10 years.

Ultimately, I am still a « fan » but I think the sadness and apathy I felt this time around point to my strong belief that 2018 is a make-or-break year for both Russia and the world economy at large.

Technology is making a paradigm shift towards electrification, central banks will have to abandon inflation targeting, and the global market will most likely be hit by a recession that monetary policy won’t be able to unwind through the mere printing of money.

The recession will come as a surprise, as the consensus is still for a « Goldilocks » scenario.

We are essentially entering a phase in which elevated geopolitical risk will link with policy mistakes – in both monetary policy and politics – to lead us into a world totally unprepared for the imminent technological paradigm shift. The effects of this shift, both positive and negative, will massively affect not only the way we live, but also the way we analyse and think about economics, data, and ourselves.

Macro scenario and trades

The global macro picture seems unable to leave behind its dogmatic focus on inflation despite clear evidence of a revolution in technology’s impact on the direction of inflation (plus demographics, debt, regulation, and the like) .

This creates major policy errors, such as hiking rates into an economic model almost entirely built on debt and a renewal of the flow of debt…

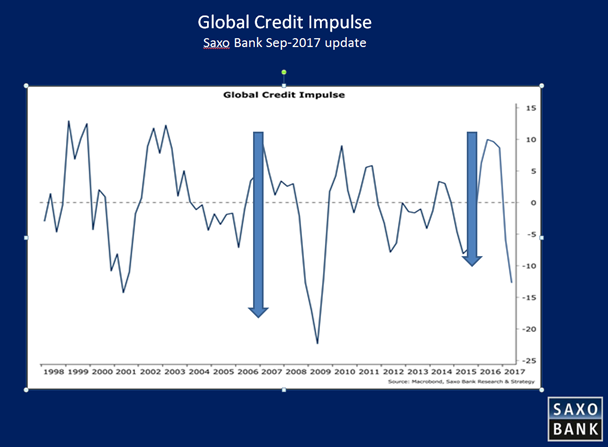

This « flow » of debt is now dropping, and it’s dropping hard. Yes, we now must return once again to our/my favorite indicator: the credit impulse.

The credit impulse leads the economy by nine to 12 months. This is seen in the chart post Q1’16 when world central banks panicked and raised the credit impulse from minus 10 to plus 10. That’s the tailwind of growth seen in Q1 and Q2 this year, but the impulse peaked in Q1/Q2 2017 which means that nine to 12 months later we expect growth to hit a low… so Q1/Q2 2018.

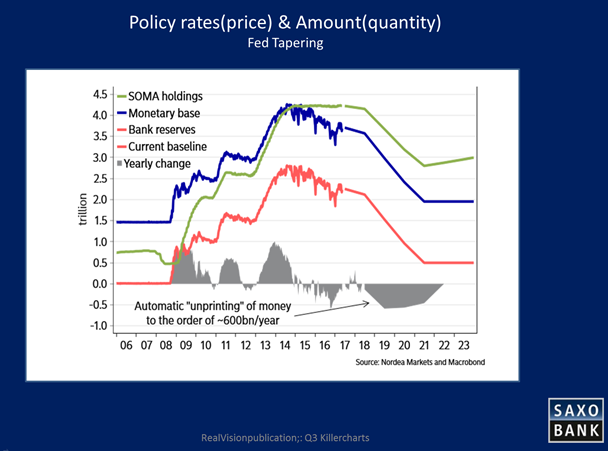

Meanwhile the stock of credit is announced to drop via quantitative tightening:

The $4 billion Federal Reserve balance sheet will stop expanding, with the result being a 60% chance of recession in the next 12-18 months.

China changes economic focus: quality over quantity and a fast drive to electric cars

The 19th National Congress of the Communist Party in China will meet in Beijing from October 18-20, 2017. This is the single biggest macro event of the year as China’s direct impact on the world economy is 31% (International Monetary Fund) and indirectly represents more than 50% of investment and credit impulse.

The focus of China’s economic plan will be on quality over quantity and the number one social issue in China is pollution. We think the recent push for electrification is one of the biggest impulse changes towards “green energy” ever made.

The “less pollution” mandate in the world’s biggest auto sales market will create havoc in the automobile industry; it will also massively impact oil demand, where “transport” represents 56% of all oil consumption.

Spaghetti interchange, Shanghai. Photo: Shutterstock

This leads directly to my new long term forecast: energy prices will be cut in half over the next five years – and probably inside the next 12 months – as markets finally « get » this massive macro impulse change and its consequential impact on oil demand:

I now a call for $20-25/barrel in WTI crude. Yes, it’s by 2030…. but trust me: next year is the year when the impact will be felt post- the Saudi Aramco IPO (which to me keeps the Middle East production caps in place for now).

The electrification of cars by 2020/30 is not only a shortcut to deal with pollution, it also matches China’s drive to be the world’s leader in technology.

President Xi will accept slower growth in exchange for a transformation from being the world’s largest labour market to the world’s biggest driver of technology embedded into the biggest demand power (China has 1.2 billion consumers and there are 4bn people overall inside the One Belt, One Road initiative).

Conclusions

I see markets testing the dollar bear scenario right now and feel October is the highest-risk month for geopolitical risk. I also, however, believe that the market has gotten carried away in terms of both valuation and implied volatility.

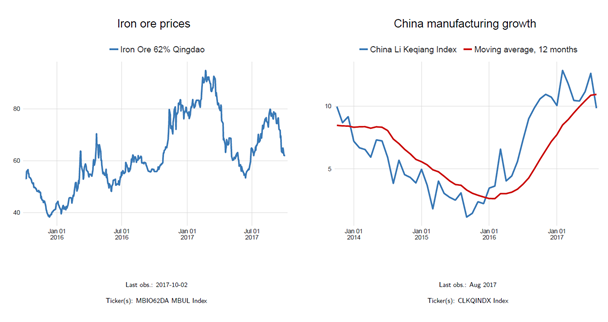

I expect data to worsen, as China data is already doing:

Source: Saxo Bank (click to enlarge)

To my mind, the market itself is the biggest risk. Any one-day move in excess of 5-6% will set off all the algorithms to hedge a market that is unhedgeable due to no market makers, the perceived “intelligence” of machines over people, and a poor understanding of fat tails.

Finally, watch gold for its direction on the USD and global risk. As my friend Jesper Christiansen pointed out this morning, the chart in gold is make-or-break:

Source: Jesper Christiansen

2018 will be a major change to monetary policy, as it’s running on empty. Perhaps the world’s central banks need to consider the old Russian proverb which maintains that « the past is unpredictable » to explain how wrong they were in tracking inflation instead of productivity.

If nothing else, however, the consequences will provide clarity. Photo: Shutterstock

If nothing else, however, the consequences will provide clarity. Photo: Shutterstock

Source:

Source:

Whow…. oil at 20$/barril in 12 month. That is a BOLD statement !

All the cars that have been produced so far in china will still run for quite a few years, they won’t be replaced overnight by EV… So china oil consomption will not drop also overnight.

Even if they are replaced, the electric energy will have to be produced, and that will not be done by « clean » energy – it is an order of magnitude problem.

Moreover, peak all oil will be reached in 2 years at the current trend. Thinking that the price will drop, with availibility dropping also, seems strange to me. And to add to this, as a lot of oil is now costly to produce, production will be cut under – say 40$ -, so we have a strong feedback effect that stabilizes the price at the current level.

I’m not saying that the price CAN NOT go there. I’m just saying that if it drops that low, we may be in deep trouble – to stay polite.

That article seems to have been written on a pure out-of-the-ground economical point of view. One day, physics will have a revenge, and that will hurt….

« An old Russian proverb asserts that times past can be as uncertain as times to come. »

Gloria Burgle: I’m pretty sure you made that up.