Macro Digest – VIX close to ALERT warning !

>14.58/60 trigger / presently 13.98

Objective: Risk warning on potential break-up in volatility and down-side in risk

Action: We suggest buying USDJPY volatility down-side as the most “clean” way of playing risk off – or buy down-side NASDAQ puts (Ask your GST person for ideas)

We are entering potential RISK ALERT on volatility and Macro Risk as measured by VIX and Citi’s Macro Risk Index:

The chart below is drawn using “Momentum model” of 100 days Donchian line

For on screen version check this link: https://twitter.com/Steen_Jakobsen/status/958282063639121920

From friend of mine: (H/T): GertH

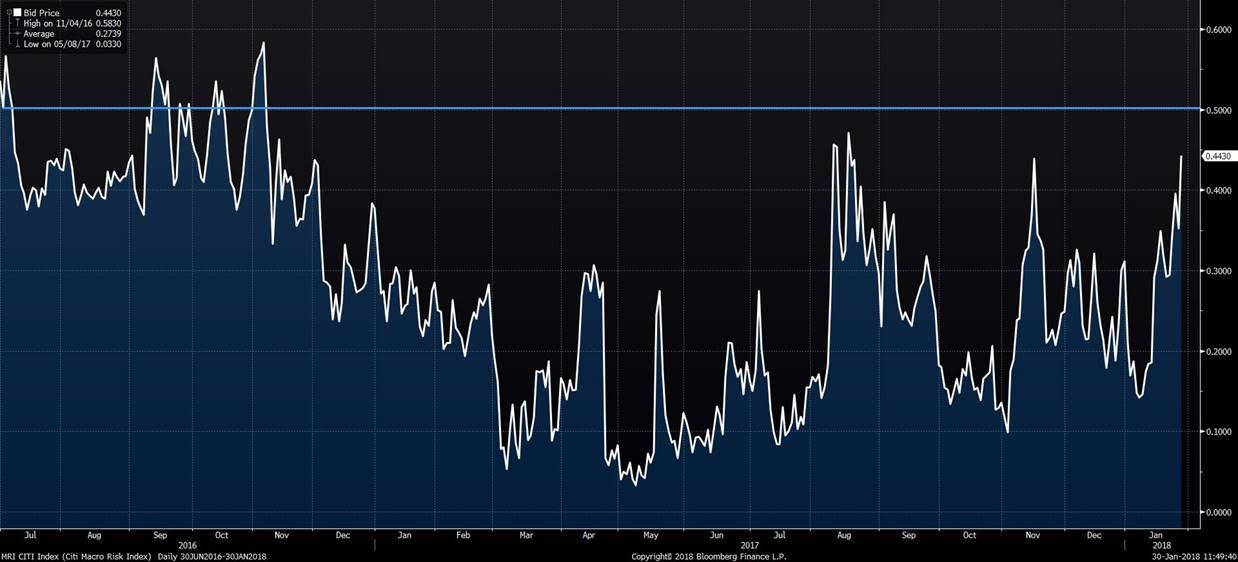

Furthermore one of the best RISK On- Risk OFF model is Citigroup’s Macro Risk Index – Note how model has not been above 0.5% since US Election. (November 2016)

What is “odd” of course being compressed credit spreads and equity valuations.

We will keep you posted on daily and monthly close of these index’ but for now a small warning is warranted, also with some event risk overnight from State-of-Union despite the widely leaked content indicating more Davos-like.

Steen

Laisser un commentaire

Participez-vous à la discussion?N'hésitez pas à contribuer!