Macro Digest : Bank of England getting ready for lift off on rates?

– Be long the underowned & priced for imperfection currencies: GBP, MXN and ZAR –

Bank of England votes 8-to-1 for unchanged.

Key phrase:

« With inflation rising sharply, and only mixed evidence on slowing activity domestically, some members noted that would take relatively little further upside news on the prospects for activity or inflation for them to consider that a more immediate reduction in policy support might be warranted. »

Kristin Forbes, the American, dissent looking for hike. Ms. Forbes is returning to academia June 30th this year, never the less this has GBP flying…

This is a weekly chart – I – remain constructive on GBP long term (>9 month) despite all the headlines on EU: (John Hardy rules < 9 month))

The weekly MACD turning up in October/November – the broader range remains intact with small positive tilt……GBP is under-owned and priced to imperfection.

Similar to what we saw earlier this year w. Mexico and South Africa – the currencies remains too cheap to both political risk and economic cycle;

GBP reaction is function of BOE moving probability up and market seeing Fed as dovish……

Credit Suisse 1YR Hike probability

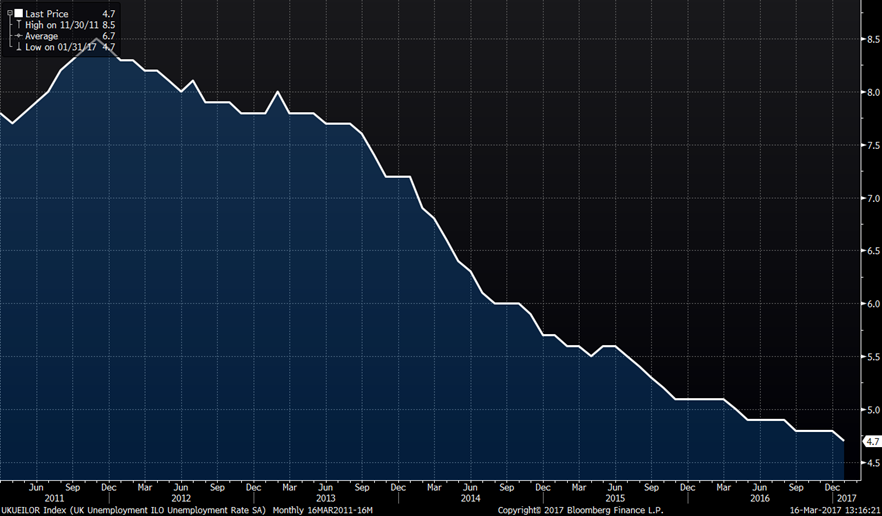

Unemployment (lagging indicator – never the less, the same trend as post ERM crisis (GBP devaluation)

Laisser un commentaire

Participez-vous à la discussion?N'hésitez pas à contribuer!