Macro Digest: Bubbles, credit and FX EM

There is some ”noise” in credit we need to monitor (See below selection of charts)

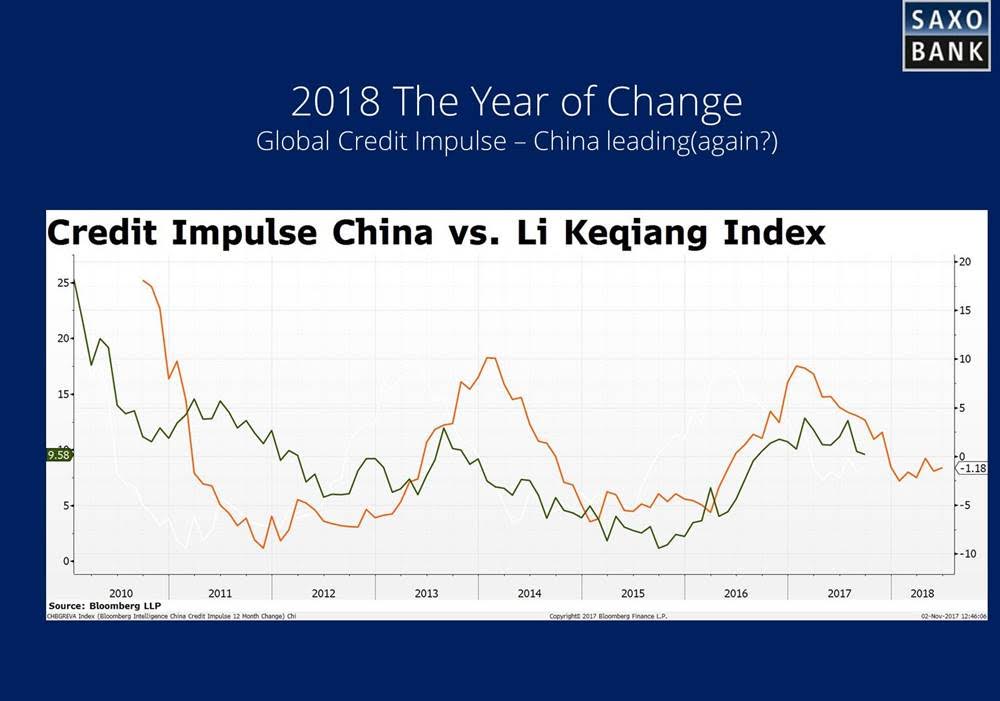

Any time the market slips, like last week, there are plenty of new bids coming according to consensus analysis, but could it be that we finally are entering phase where both the primary money printing (Fed+ BOJ + ECB + BOE) is coming to a stop plus the first derivative – credit impulse- is imploding having an impact on credit and hence the economy? I think so, you all know I am firm believer in credit impulse and its leading projection of growth (and credit volumes)

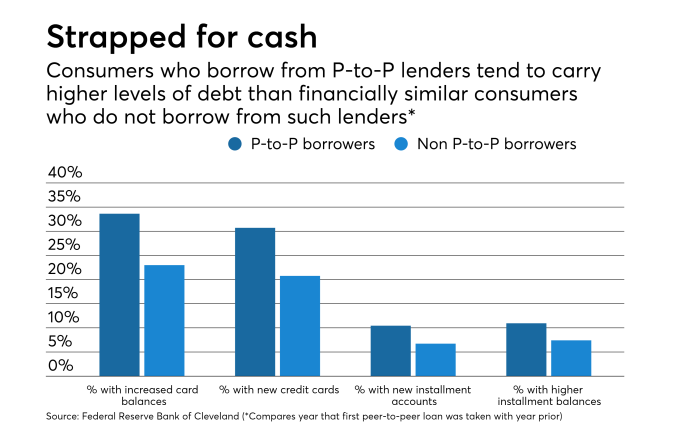

My friend Daniel caught this interesting story:

https://www.americanbanker.com/news/online-loans-leave-consumers-deeper-in-debt-fed-research-says

This in peer-to-peer lending not far from ICO, Initial-coin-offering in crypto space, which shows that a bubble is forming and this, like crypto currencies in a TOTALLY unregulated space!!!! This may be the next bubble to burst – who will protect unregulated borrowers, and which agency should do it? Of course, the crypto space is even more in bubble territory!

Yes, you can mathematically say if a market is in a bubble or not – when prices becomes super-exponential, rising growth YoY, it’s a bubble (link: Super-exponential endogenous bubbles in an equilibrium model of fundamentalist and chartist traders)

Meanwhile old Kings of Dow like GE is collapsing in price while companies with ZERO earning, but only hope: Read: Tesla, is flying high on storylines which makes Trump look humble….Indeed… of course we can’t predict the next down move, but the market is heating up, as the many “support channels” are weakening gradually, this is, to me, a time to be EXTREMELY conservative in your asset allocation.

Note: The correlation btw S&P(inverted here) and credit spreads broke down – Either credit comes roaring back or S&P needs to correct to 2450/75 level.

Note: A look at different risk tranches and the outsized move last week… most of these moves has a Z-score of >+2!

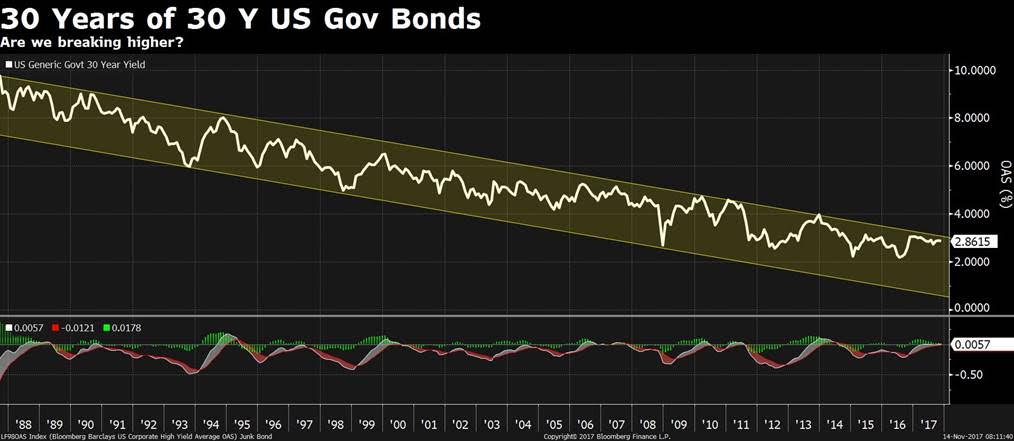

Note: This is 30 years of 30 Y US Government bond yield – we are clearly entering phase where the break is a “risk”…. I doubt we make move higher on this channel on the first attempt – 30 Years is a long, long time – rather I think the credit impulse impact will be felt in data from November and December when they become available in January:

Note: This is the Chinese Credit Impulse 12 month forward vs. The Li Keqiang Index (which is one of the best leading indicators for China growth) – Looks like that we post the Communist Party Conference will see consolidation and lower growth impulse.

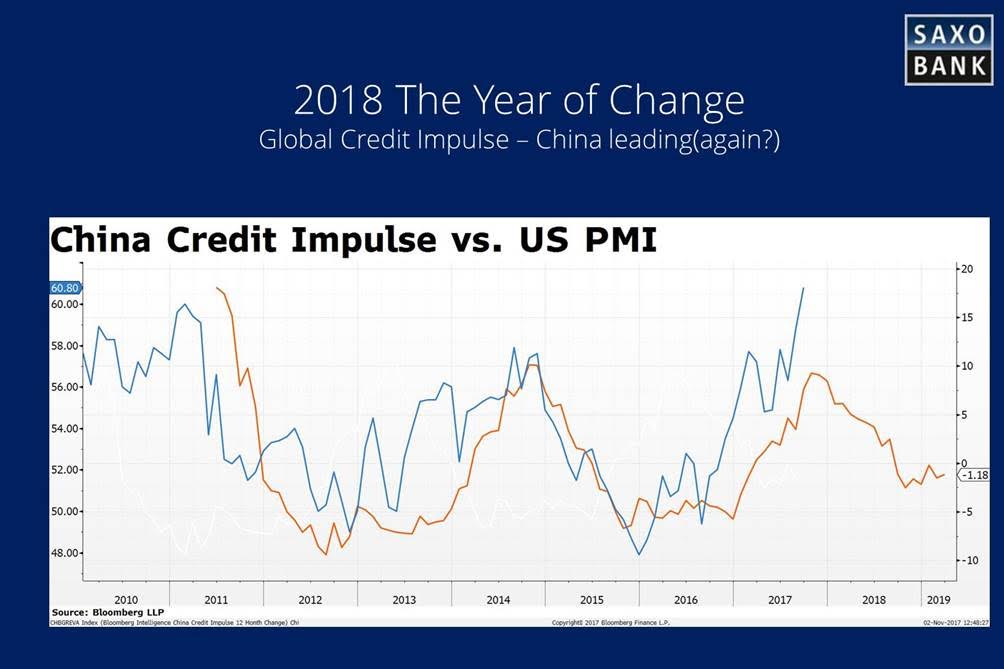

Note: This is linking the Chinese Credit Impulse to the US PMI (proxy for “high in hopes”) – we should be topping round about now for impulse….

Note: JPM Emerging Markets (FX) is also testing it’s lower channel – this one is key (ZAR, RUB, MXN making new lows vs. Dollar)

Conclusion

We are entering a period where bubbles (stock market, crypto currencies, credit space, real estate) meets a new economic reality of negative credit impulse and the end of central bank support.

This happens in a global environment of rising global tension (North Korea, Syria, Saudi Arabia, Qatar, Venezuela and Brexit) and a rising inequality and religious hard-wiring. A very dangerous cocktail. This time of the year we normally have a Christmas Rally to pay for the underperformance in the first nine month, maybe 2017, is upside-down , we get market set back as managers and traders alike pare down risk to control and keep the nice profit given to them courtesy of shortsighted central banks who is in the 11th inning of a game which should ended at the bottom of the 9th.

We have lowest risk exposure in years right now:

Fixed Income: UW

Commodities: UW

Equity: UW

Cash: OW

The main “convictions” being:

- Dollar is long-term down channel – small risk of 97.00 in DXY (94.50 today) but 85.00 next year

- FX EM and soon EQ EM is biggest short – FX EM is tanking hard and led credit down.

- Crude topping here and falling 50% next 24 months

- Next “revolution” will be driven by R&D in Electric Cars, where China and soon India will join China in 100% electrification – This will unleash biggest productivity gain since 1870-90 as money flows to “real problems” instead of into bubbles.

- In equity we like biotech, e-commerce (Asia centric), robotic & automation, plus selective mining plays – We are enticed by Woolworth(South Africa) and GE at these levels in the old “world”

- The commodity the favorite is silver based on industrial usage and underperformance

Safe travels,

Laisser un commentaire

Participez-vous à la discussion?N'hésitez pas à contribuer!