Steen’s Chronicle: The Manipulation Game

Last weekend I once again watched The Imitation Game, the movie about Alan Turing, one of our life time biggest heroes and by many considered the father of the computer. The movies is top three ever for me, as it’s show the tale of an outsider who despite all odds finds a solution to a problem, the German Enigma machine. Furthermore in doing so he created a true paradigm shift in all future by enabling computation in machines. An outstanding story, a true hero, and something which should inspire today’s entrepreneurs away from money to prober needed changes.

Of course this is not a Chronicle catering to film buffs but I want to use the title – The Imitation Game to illustrate a newfound insight into the world of finance and politics given to me this week by my friend Mark Voller.

Macro is waste of time or is it?

I have long argued that macro policies are net negative on society by removing a focus on the micro economy, SME’s vs. SOE’, incentive structures and marginal allocation of capital, towards big business and lobbyism. Furthermore its done by virtue of the clearly wrong premise that anyone knows and understand what is right and wrong for a complex animal like an economy or a market at any given time.

I argued macro was really waste of time, despite being a macro economist.

This has met considerable resistance especially from policy makers and career macro economist’s, and I was wrong. Not wrong in the impact of macro being negative, but in that it does not matter.

The reason it matters is due to the modus operandi of central bank and policy makers. They have zero ability to predict anything, they have worse information than market due to structural deficits of models built in the 1970s and decision making based on consensus.

This means they always will be late and always forced to reverse engineer the economic outlook to fit the economic reality.

Reverse Engineering Macro Prudential Frameworks

Let me introduce you to Reverse Engineering Macro Prudential Framework, REMPF; todays monetary and political business model.

The way REMPF works is as follows:.

You have a narrative – for the Fed this narrative is presently to “normalize” interest rates to 2% (and not three to four hikes as per their projected dot-plots) by end of 2018. Inflation remains subdued so reaching 2% in an undisruptive way means a slow grinding inflation could work to create this.

Voila! Fed sources, and often coordinated with other central banks, starts to reflect an inflation outlook which is moving from being at risk of undershooting in 2017 to widely being expected to the reach 2% in the medium term. There is no real inflation change, but the big change in wording feeds into Fed watchers raisingexpected inflation as measured by 5y5y US interest rates

(Note how inflation expectations was significantly higher in 2013 and 2014, but please ignore facts!)

Another reality is that this measure is barely above its 200 SMA @ 228 bps, but forget facts, the “message” is more important as Fed needs more inflation to justify the increase in Fed Funds.

Now this is not convincing so what happens next? A “reliable” central bank in this case: Federal Reserve of New York, introduces a new measure of inflation in May 2017, coinciding we a need to normalize Fed funds!

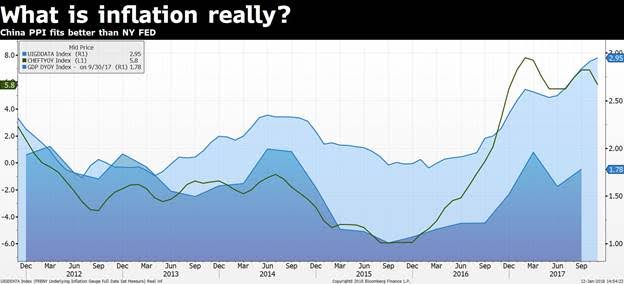

The New York FED underlying inflation gauge is all of sudden born and immediately adopted into any reference of forward and past history of inflation spurs. Despite being born in May 2017! The problem for those who live in the real world is that this new measure does poorly against my preferred inflation lead: China’s PPI YoY. Again ignore facts understand the story! (Remember the only true inflation is the GDP deflator – as this is the index, price, which encompass all of the economy) – Reverse Engineering Macro Prudential Framework creates its own data to feed the narrative. Beautiful! Nes pas?

How does the Tax rebate and Trump impact this model?

Remarkably there is yet no real signs that Fed or global central bankers “buys” the concept that the US Tax rebate (my wording as ‘reform’ is a joke as word for this hand-out) will materially matter for the neither US growth or inflation. Maybe because if inflation does spike they will later add the tax rebate to the narrative, but including it now would risk an overshoot of the expected inflation, so for now we have inflation ex net changes from tax rebate. Interesting, counterintuitive and amazingly naïve.

The newest Reverse Engineering Macro Prudential Framework project

There is on the other hand a growing believe that as QT and Tapering is happening this should be globally coordinated to reduce the individual central banks risk. Better for all us to be wrong than one going it alone. Group think.

Voila, once again, all of the sudden both ECB (in their Minutes and action) and BOJ (in action not yet in Minutes) reverses off feeding cheap money towards a focus on a synchronized normalization of monetary policy based on increase in inflation and improving sentiment.. This proves that they all use the same playbook, correlated action and narrative. Group think.

The Real Economy

Meanwhile in the real economy, the IIF reports that worlds debt have increased to 233 trillion USD – or an annual increase of 13% YoY vs a nominal global growth of maximum 5% last year. In other words 2017 was again a year where growth was fed from increase in leverage and credit rather from improving economic conditions and reforms.

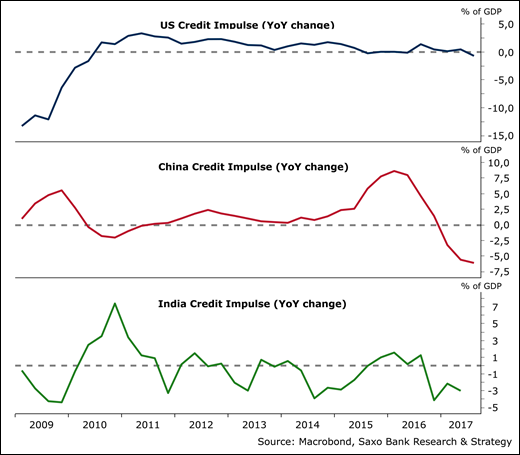

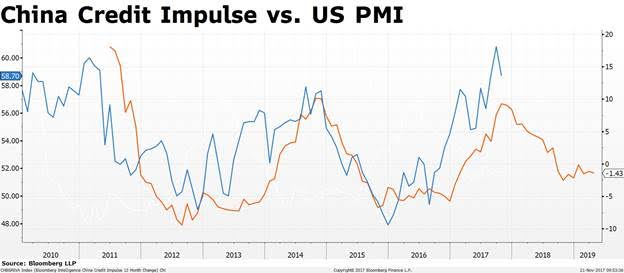

We argue, and continue to argue, the whole of the improvement, comes from the big credit impulse from 2016 post Q1- Q3 which leads globally economy by 9 month.

The peak, as defined by our global credit impulse will be in Q1 of 2018 and will be followed by a significant slow-down driven almost entirely by China initially but now supported by the action described in the REMPF above.

Here we coincide the lead of 9-month with the US PMI.

My point is policy makers is reverse engineering their outlook based on their narrative. There is no forward looking scenarios.

This will once in a while deviated too much from the reality. Read: The global credit impulse.

This is exactly what is about to happen. The naïve and backward looking policy makers will implement faith based decisions on hiking rates and normalizing into a world economy which continues to be driven by debt but with a smaller and smaller credit cake, so much so that Q2-Q4 could see significant slow-down of first Chinese growth but ultimately US growth as well.

How does this impact you?

Well, first of all learn from the REMPF way of thinking. This week the market was full and busy talking about the break of 30 year trend in 10Y US FI:

The critical level is 255-265 bps – but only on a monthly close, meanwhile Wall Street is willingly buying the REMPF narrative: The game is “Normalisaton. The outlook is now 200 bps-250 bps Fed Funds by the end of 2018 and apparently we are underestimating how much Fed can do (no we are not) – and inflation will kick into full force driven by the Phillips Curve which is coming back with a vengeance. (We just need to create another measure of employment to fix what is wrong with it) adding to the commotion is now well respected Guru’s:

But… Hang on a minute!

How does a much higher US interest rate fit the REMPF? It doesn’t is the answer.

The amount of debt and the lack of velocity of money is the weaker link of the present macro model. Only by keeping interest low does the monetary authorities keep a directional power of the markets and sentiment. No, what the narrative says(and wants) is that a slow grinding interest rate towards 3% over the next 24 month, not in a hurry and definitely not in a forced manner. Hence this, if my “model” is right, is a big buying opportunity for US fixed income! If rates does go up, then Fed (& their G/) friends will “untaper” again – at least rhetorically. Supporting your long position!

Same arguments can be made on the stock market – higher stock markets validates the controlled narrative, falling stock prices the opposite, hence securing ever rising stock market is an important ingredients of the REMPF!

I started by referencing to The Imitation Game, and I will end by welcoming you to new movie to watch: The Manipulation Game, starring the world central bankers and politicians in lead roles, and a story line which is based on the good old pretend and extend. Pretend you are credible and in the know. Extend by buying time, most complexed systems like economies are driven more by noise than trends anyway!

PS: Buy get long US Treasuries below 148/149 in UST or close to 122.00 in TLT ETF.

Safe travels,

Laisser un commentaire

Participez-vous à la discussion?N'hésitez pas à contribuer!