Macro Digest: ECB hit MASSIVE PANIC button – what’s next…

Draghi is failing the Feyman test of knowledge/facts:

Not only is ECB hitting panic button but risk remains to the downside!!! See this morning PRE-ECB note from me.

Our overall macro path from here is:

Now the Global Policy Panic theme I outlined in December is complete. Next up in H2-2019: The Global Fiscal Panic (or Welcome to the M.M.T)

First PBOC caved, then FED, then BOE, and as always last came ECB – predictable.

What’s also predictable is that TLTRO is REALLY only meant to “buy time” from the expected kick in of MMT / fiscal expansion (under headline – infrastructure) in H2. Hence the move to September …..Post the European Parliamentary Election in May the focus will be on creating more spending inside the Populist/MMT camp. They will succeed exactly because ECB is now incapable of doing anything to counter their own monster of a market with no price discovery.

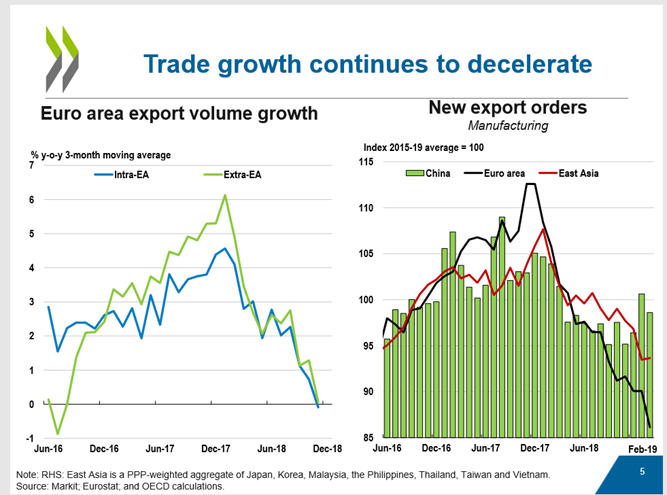

Between now and H2 the data will continue to worsen as the global supply chain is broken – EUROPE is to lose the most, because it benefitted the most! OECD sober outlook is now high-end growth projection.

So….. what does it mean:

Short-term:

- BTP & Club Med spreads should improve – The slowing growth makes Germany partner with Italy and ECB, hence “indirect support” just increased into lower inflation and lack of yield

- Our 1.03/1.05 EURUSD call has increased odds probably from 50/50 chance to 60/40 (Position through CHEAPEST volatility EVER!=

- Banking sector (SX7E) should do well next week-ish, but do note – Banks already anticipated this with YTD return of 14%

- Dollar strength could shift momentum out of commodity & EM through rising DEBT load from stronger USD.

Medium-term:

- European Parliamentary Election creates more EVENT risk – and increase in call for fiscal spending

- Inflation expectations could start to rise slowly (from H2 -start –

- Data can not sustain the built-in overconfidence in sentiment – turning the needle down on price of money really makes ZERO difference – TLTRO really is just “state support” in Keysian way.

Long-term (H2-2019)

- Europe will enact fiscal panic. The EZ budget deficit to GDP @ -1% in 2018 – ECB plus EZ will see this a “free money” – don’t forget low inflation is biggest risk in a central banks outlook – not lack of credit, inequality or market valuation.

- MMT – learn, educate yourself – not hard – I promise!

- EUR hits 1.03/1.05

- Germany joins Italy in recession

- 10yr Bund yield goes to – 50 bps

- EU equity will be dirt cheap in relative and absolutely terms.

- There could be big opportunity for EUROPE through growth crisis to implement longer vision for Europe. I see Europe “needing” as crisis to redefine itself.

Despite – above – Safe travels,

Steen

Laisser un commentaire

Participez-vous à la discussion?N'hésitez pas à contribuer!