Steen’s Chronicle: The big nothing?

“I love to talk about nothing. It’s the only thing I know anything about” – Janet Yellen……….sorry Oscar Wilde J

Finally! Saxo Bank’s Outrageous Predictions is out: Saxo OP-2016 Link to PDF and less important: Fed hiked!

My ‘real’ 2016 outlook in headlines will be this:

- US Dollar will weaken – it will follow the “normal path” of weaker US$ post the first hike.https://pbs.twimg.com/media/CVEL-skVEAAyeOs.png:large

- China will do better than expected – the easier monetary policy, but more importantly the “internationalization of RMB” will drive demand up, not down

- Emerging market will be the best performing asset – it has both price and value being cheap. Argentina moving to floating currency is first good news in three years and more is to come.

- 2016 will be a year of two halves: A bad start, and a good finish. S&P will trade both 1.800 and 2.200 during the year, but overall 2016 is a “year of transition from zero bound, none working policies towards a new business cycle which will start with a “bust” and then a new start.

- El Nino will impact inflation, growth and commodities positively: https://pbs.twimg.com/media/CWIgP6kUAAARm_6.png:large

- Inflation will be higher next year – higher than expectations: El Nino adds 0.2%, base effect another 0.2% and then some demand pull and more credit flow.

Federal Reserve – Fed says four, market says maximum two – I’m with Fed

Fed left it was late, probably too late, but the tone of the press conference and “dots” indicates Fed high believe in their forecasts.

Four hikes is on the cards for 2016, the market consensus is two hikes offered – the gap remains and for now the risky assets trades on fading the Fed.

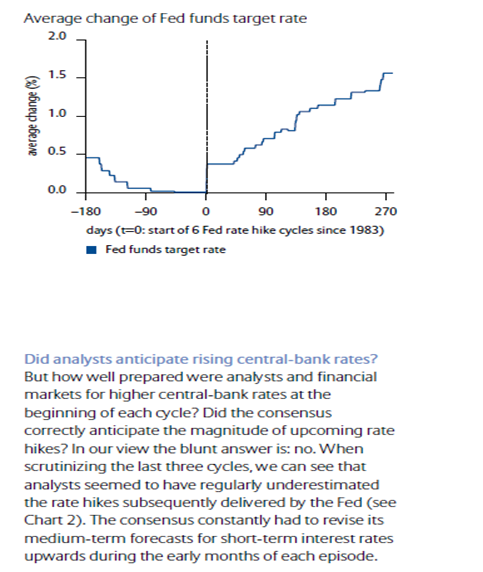

Fed however do tend to deliver the promised hikes. An excellent piece “Historical lesson from Federal Reserve rate-hike cycles” from Allianz Global Advisors proves the point:

Most commentators of course thinks this time it’s different – always is right?

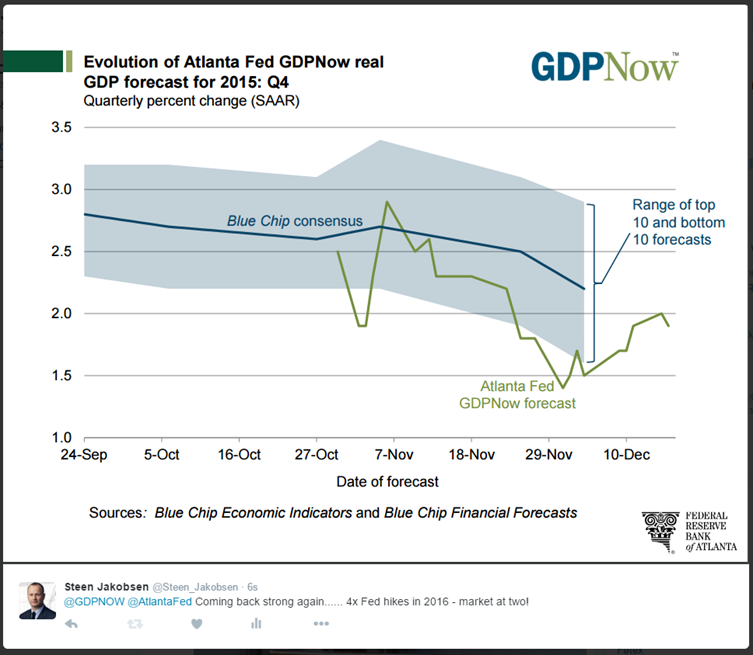

Q4-GDP looks better and better, my favorite indicator: Fed Atlanta’s GDPnow is now well inside the consensus:

The big question: Inflation or not?

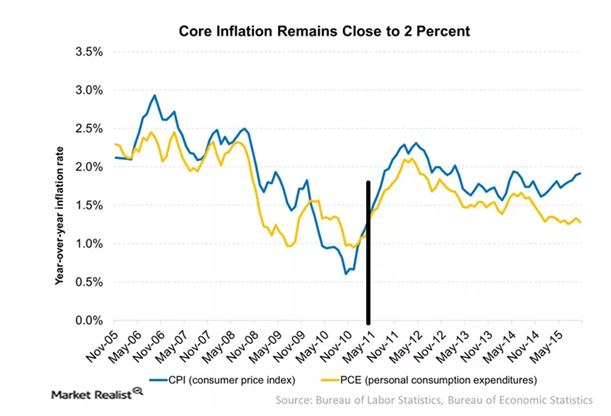

The main “new information” I got from Chairwoman Yellen was her increased confidence in inflation picking up – here lies a potential “explanation” between Fed and market. Market simply does not buy higher inflation despite these headline recently:

Euro core inflation at two year high and overall core-inflation have not only increased by stayed closed to 2% at all times here is the link to Yellen direct answer to inflation

Meanwhile my main theme for Q3 and Q4 of this year – the price of capital rising continues – I don’t need to remind you but it has been carnage.

Tactical

I leave 2015 risk wise very light on positions – my price signals is not flashing yet and the only optionality I will want to own is upside in crude (WTI), Gold/Silver and weaker US$.

It will take the market a week at least to “get…” the message that the cost of money has now started a move higher and probably much higher than most people can even imagine. 80% of all trader in the market today have never lived through a Fed hike cycle and the cost of capital needs to rise – the 57 trillion US$ of debt which has financed the meaker growth we have seen since 2009 now needs to be addressed.

Thank you,

Let me use this opportunity to say thank you to all the customers, investors, conference attendees, media and colleagues I have met in my busiest year ever.

I have been on the road for more than 120 days, been to more than 30 countries, but everywhere I am astonished how smart, open and engaged everyone is and this despite me often telling you that you are the dumbest generation ever, the most bland, the most average, and the least productive!

This ability to accept the discussion, for us to have the conversation has been the highlight for me and it’s a sign of not only a willingness but also a commitment to move towards a mandate for change.

I wish all of you a happy holidays, may the presents be large and plenty,

Safe travels,

Steen “Santa Claus” Jakobsen

Laisser un commentaire

Participez-vous à la discussion?N'hésitez pas à contribuer!